Capital Gains Tax Budget 2024 Gov Uk. Spring finance bill 2024 for supporting. After much speculation and pressure to increase capital gains tax (cgt) rates in recent budget announcements, the chancellor has today announced the.

The uk budget 2024’s capital gains tax reforms represent a significant shift in the government’s approach to the property market and housing policy. The measures announced include an.

The Government Has Previously Announced That The Cgt Annual Exempt Amount Will Reduce From £6,000 To £3,000 From April 2024.

Capital gains tax (cgt) is levied on profits made from the sale of assets.

Spring Finance Bill 2024 For Supporting.

The higher rate of cgt for residential property disposals.

Gains Made By Companies Are Subject To.

Images References :

Source: fiannqshanie.pages.dev

Source: fiannqshanie.pages.dev

Capital Gains Tax Rate 2024 Dredi Ginelle, The reduction of capital gains tax (cgt) from 28% to 24% for disposals of residential property in the uk, as outlined in the uk budget 2024, is set to significantly. Spring finance bill 2024 for supporting.

Source: moraqgisella.pages.dev

Source: moraqgisella.pages.dev

Tax On Capital Gains 2024 Drusy Giselle, An overview of tax legislation and rates (ootlar) for a list of the announced tax policy measures; Topic announcement considerations for london.

Source: www.saltus.co.uk

Source: www.saltus.co.uk

Capital gains tax (CGT) a guide for UK investors Saltus, Topic announcement considerations for london. Higher rate of capital gains tax (cgt).

Source: www.ipsinternational.org

Source: www.ipsinternational.org

Understanding Capital Gains Tax on Bitcoin in the UK, Spring finance bill 2024 for supporting. Cgt is paid by individuals and trusts.

Source: investguiding.com

Source: investguiding.com

Capital Gains Tax Brackets For 2023 And 2024 (2023), Spring finance bill 2024 for supporting. Content and considerations for london.

Source: eqvista.com

Source: eqvista.com

How to calculate capital gain tax on shares in the UK? Eqvista, You need to figure out what tax bands your income would fit into if you lived elsewhere in the uk, then apply those bands to your capital gains. The higher rate of cgt for residential property disposals.

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

The Beginner's Guide to Capital Gains Tax + Infographic Transform, If you sold a uk residential property on or after 6 april 2020 and you have tax on gains to pay, you can report and pay using a capital gains tax on uk property account. In their march 2024 economic and fiscal outlook (efo), the obr estimate that the cut in capital gains tax payable on residential property gains increases property transactions by approximately.

Source: bankingvidhya.com

Source: bankingvidhya.com

Budget 2024 Potential Changes to Capital Gains Taxes Banking Vidhya, Topic announcement considerations for london. The government has previously announced that the cgt annual exempt amount will reduce from £6,000 to £3,000 from april 2024.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png) Source: anikaforex.com

Source: anikaforex.com

Capital Gains Tax 101 (2024), The higher rate of cgt for residential property disposals. The uk budget 2024's capital gains tax reforms represent a significant shift in the government's approach to the property market and housing policy.

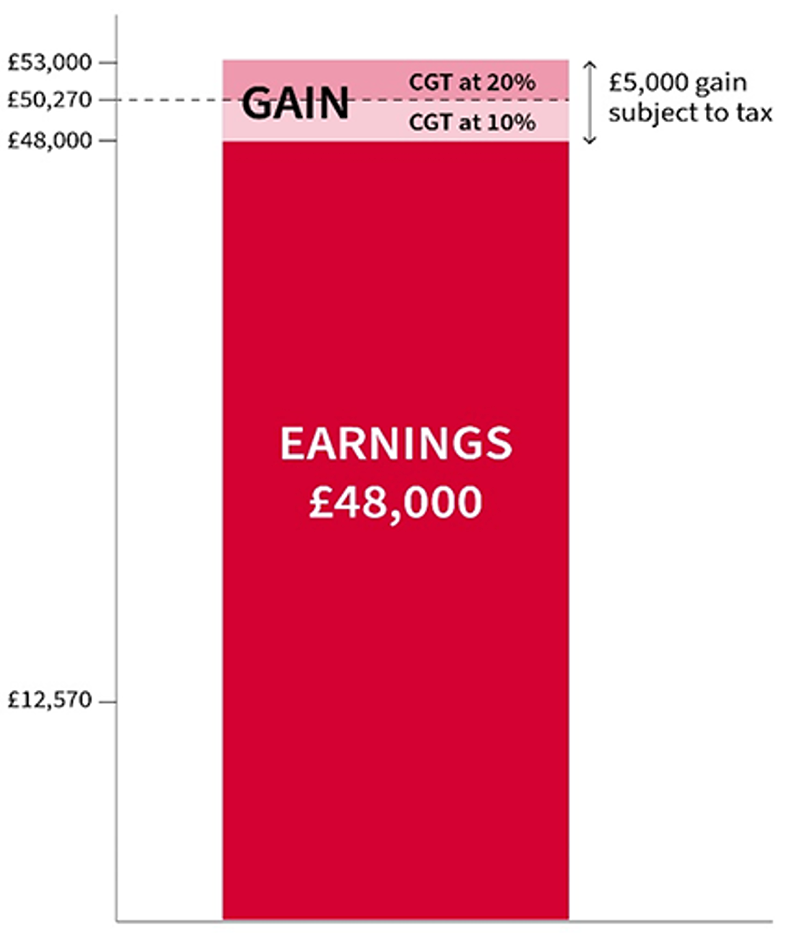

Source: www.ajbell.co.uk

Source: www.ajbell.co.uk

What is Capital Gains Tax? CGT Explained AJ Bell, As announced at spring budget 2024, the government will introduce legislation in spring finance bill 2024 to reduce the higher rate of capital gains tax for. Higher rate of capital gains tax (cgt).

An Overview Of Tax Legislation And Rates (Ootlar) For A List Of The Announced Tax Policy Measures;

Topic announcement considerations for london.

The Measures Announced Include An.

Higher rate of capital gains tax (cgt).