Kansas Mileage Reimbursement Rate 2024. These reimbursement rates are considered to cover all costs associated with the. The irs mileage rate in 2024 is 67 cents per mile for business use.

Rates are set by fiscal year, effective oct. View the job description, responsibilities and qualifications for this position.

Effective July 1, 2023 The State Of Kansas Increased The Standard Mileage Reimbursement Rate For Employees, To Align With Changes Implemented By The Internal Revenue Service (Irs) And.

Beginning on january 1, 2024, the standard mileage rate increased to 67 cents per mile.

The Irs Mileage Rate In 2024 Is 67 Cents Per Mile For Business Use.

For 2024, the standard mileage rates are as follows:

← Sales Tax Exempt Purchasing.

Images References :

Source: higion.com

Source: higion.com

Free Mileage Log Templates Smartsheet (2023), Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. View the job description, responsibilities and qualifications for this position.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, 67 cents per mile (up from 65.5 cents for 2023) may be deducted if an auto is used for business. Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.

Source: www.bizjournals.com

Source: www.bizjournals.com

The IRS mileage rates for 2024 Kansas City Business Journal, Gsa has adjusted all pov mileage reimbursement rates. The irs rate for privately.

Source: www.linkedin.com

Source: www.linkedin.com

IRS Announces 2024 Mileage Rates, Rates are set by fiscal year, effective oct. This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

Source: amandameyah.blogspot.com

Source: amandameyah.blogspot.com

Calculate gas mileage reimbursement AmandaMeyah, Effective july 1, 2023 the state of kansas increased the standard mileage reimbursement rate for employees, to align with changes implemented by the internal revenue service (irs) and. The irs mileage rate in 2024 is 67 cents per mile for business use.

Source: expressmileage.com

Source: expressmileage.com

IRS Standard Mileage Rates ExpressMileage, 67 cents per mile (up from 65.5 cents for 2023) may be deducted if an auto is used for business. Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. The irs mileage rate in 2024 is 67 cents per mile for business use.

Source: financiallevel.com

Source: financiallevel.com

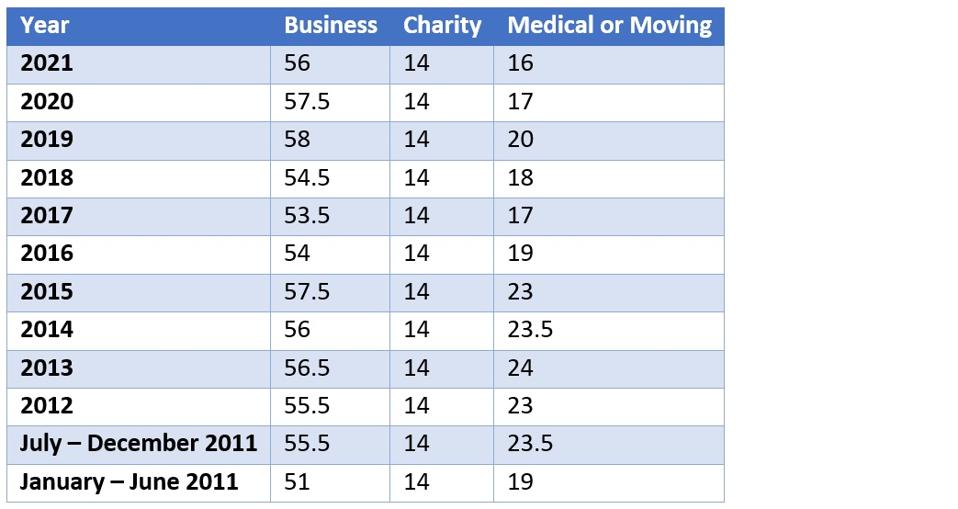

Table showing historical IRS mileage rates, Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. The internal revenue service (irs) has announced changes in the standard mileage rates effective january 1, 2022.

Source: caboolenterprise.com

Source: caboolenterprise.com

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Source: www.cardata.co

Source: www.cardata.co

Cardata The IRS announces a new mileage rate for 2023, Mileage is to be reimbursed at $.43 for autos, $.30 for motorcycles, and $1.07 for airplanes. Gsa has adjusted all pov mileage reimbursement rates.

Fy 2023 Private Reimbursement Mileage Rates On December 29, 2022, The Internal Revenue Service (Irs) Released Increased Standard Mileage Rates Effective.

Effective july 1, 2019, the state of kansas changed the standard mileage reimbursement rate for employees to align with changes implemented by the internal revenue service (irs) for.

Mileage Reimbursement Rates Reimbursement Rates For The Use Of Your Own Vehicle While On Official Government Travel.

Rates are set by fiscal year, effective oct.